Which is Best for You

In this article, we’ll cover the three most popular Medicare Supplement plans and the scenarios or situations in which each plan is the right fit for someone considering a Supplement.

When it comes to choosing a Supplement, the government makes it super easy. By federal law, ALL plans must have the same benefits across different companies. A Plan F with Mutual of Omaha will have the exact same benefits as a Plan F with Aetna or Blue Cross Blue Shield. Essentially, the ONLY difference is the price you pay.

Now, is that all there is to it — just figure out the plan you want and choose the cheapest company? I wish it was that easy, but choosing the cheapest company could actually cost you tens of thousands of dollars in extra premium over the years that could’ve gone toward more important expenses instead. By the end of this article, we’ll explain how to avoid this No. 1 mistake that Supplement owners make when shopping for a Medigap plan on their own or with a novice agent.

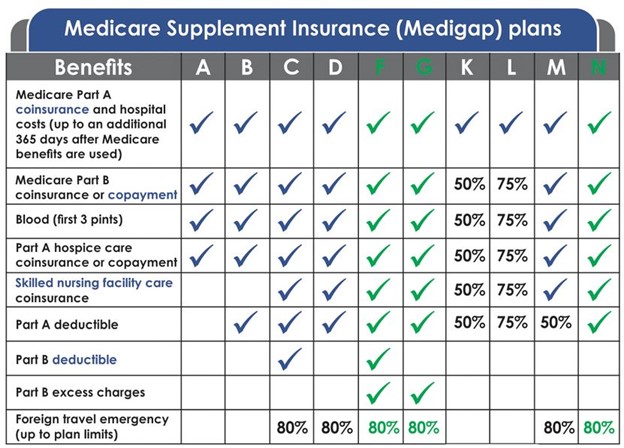

We’ll be comparing Plans F, G, and N. There are more plans, but the majority of seniors who have a Supplement will have one of these three plans. We’ll compare what each plan covers with respect to the official Medicare Supplement benefit chart below.

As you look at this chart, you’ll notice that the benefits on the left correspond to the actual Medicare cost-sharing amounts the government covers with Parts A and B. Those on a Medicare Advantage or Part C plan will often have completely different benefit structures and cost-sharing amounts compared to Medicare Supplements because Advantage plans replace Original Medicare — whereas a Medicare Supplement plugs the gaps in Medicare with a few added benefits, such as Part B excess charges, blood, and foreign travel. We’ll cover excess charges in more depth when we talk about Plan N.

As we go through these three plans, we’ll cover:

- What gaps each plan fills or the amount of coverage you get

- How much the average monthly premium costs depending on: ‘

- Age

- Gender

- Tobacco use

- Zip code

- Expected rate increases you may see while on the plan

After we go through the top three plans, we’ll summarize the pros and cons of each plan to help you decide which one is best for you.

Plan F: The Cadillac Plan

Plan F Coverage

Plan F is called the Cadillac plan because it’s the most benefit-rich, as it covers all the Part A and B gaps — leaving you with no out-of-pocket costs. In 2015, Congress passed the MACRA law that retires Plans F and C because these plans pay “first-dollar coverage,” meaning there’s no cost-sharing on behalf of the Medicare beneficiary. Congress felt that seniors with first-dollar coverage were abusing the system and causing higher costs for everyone because they could go to the ER for a headache and not worry about paying any bills since their plan paid EVERYTHING.

This means that folks who became eligible for Medicare after 2020 are not allowed to enroll in Plan F or C anymore. The choices for them are between Plan G and N, which we’ll cover below. Folks who are already on a Plan F can choose to keep their plan and even switch to a cheaper company if they want because their Plan F eligibility is permanent.

The only thing that Plan F doesn’t cover (besides dental, vision and hearing coverage) is long-term care. A lot of seniors mistake skilled nursing care to mean nursing home care, which is totally different. To qualify for skilled nursing, your health condition must show progress or else you’ll be sent home or to a long-term care nursing home that specializes in palliative care. Only a long-term care insurance policy can pay for that.

Plan F Premiums

The monthly premiums for Plan F are the most expensive compared to any other Supplement, because it covers more for you. Below are the rates for both women and men who do and don’t smoke, according to age for a random Ohio zip code.

[TABLE]

These rates don’t include all the different companies’ rates, just the most competitive ones for each of the variables above. Obviously, these rates will also differ in different zip codes. Some zip codes may be more expensive, which is why it’s imperative to find an insurance broker who can compare all of your options.

Plan F Rate Increases

As we mentioned before, you have to account for expected rate increases — not only from a specific company but also by plan.

Plan F rate increases are high, usually ranging from 6-15%, and that’s on TOP of the annual rate increases you’ll experience as you age. It’s possible to have a rate increase due to age, and then another increase later that year. Sometimes I’ve seen multiple rate hikes in one year! You can’t predict when these hikes will happen, but it’s wise to know what to expect when you’re deciding between Supplement plans.

Why are the rate increases so high on Plan F? It’s because every year, CMS increases the Part A and B deductibles, coinsurance, etc., and Plan F must cover all of those expenses, so the insurance companies correspondingly raise their rates to account for the annual increase.

If you’re trying to save more money and deal with lower rate increases, then you might want to look at the next two plans to see if they’re a better fit you.

Plan G: The New Gold Standard

Plan G Coverage

After MACRA legislation did away with Plans F and C for everyone except seniors who were eligible for Medicare BEFORE 2020, Plan G became the No. 1 go-to Supplement. It covers all the costs for Part A and B minus the Part B deductible ($233 for 2022). After the annual deductible is paid, your medical care is essentially ‘free’ for the rest of the year.

Likewise, Plan G doesn’t cover ancillary needs like dental, vision, hearing, or long-term care. However, if you were to have a stroke, heart attack, or cancer, Plan G will pay for all your care minus prescriptions, which are covered by your Part D prescription drug plan.

Plan G Premiums

Medicare Supplement Plan G is always cheaper than Plan F because it doesn’t have to cover the increase to the Part B deductible that happens every year. If you were to subtract the Part B deductible from your monthly premium, you’ll often see an additional savings with Plan G, which is essentially what the insurance company charges to handle that deductible for you. Sometimes you’ll see an additional annual savings of $100-$200 or more (depending on where you live) beyond the deductible. This comes out to $25-$50 less in monthly premium compared to Plan F.

If you’re a healthy person who doesn’t have to see the doctor often, chances are you might not even satisfy the whole deductible in a year, which means additional savings for you!

Below are the rates for both women and men who do and don’t smoke, according to age for a random zip code.

[TABLE]

These rates don’t include all the different companies’ rates, just the most competitive ones for each of the variables above. Obviously, these rates will differ in different zip codes. Some zip codes may be more expensive, which is why it’s imperative to find a broker who can compare all of your options at no charge.

Plan G Rate Increases

Compared to Plan F, Plan G rate increases are lower over time because the companies don’t need to raise rates to accommodate the increase in the Part B deductible. Usually, you can expect rate increases to stay around 6%. I’ve seen them lower, and sometimes I’ve even seen rate decreases where the company LOWERS the annual premium — though that’s rare.

In addition to lower premiums compared to Plan F, you can also expect lower rate increases with Plan G. Charted out, you can see how you’d be paying a lot less over time compared to someone who has a Plan F, which pays for everything. It simply isn’t worth it to let the company pay the Part B deductible for you.

Plan N: The Best Value for Your Dollar

Plan N Coverage

Plan N is perhaps the most cost-effective Medicare Supplement plan — saving you even more money than a Plan G (or F for that matter). In exchange for Plan N having a cheaper premium, you’ll have to pay more out of pocket for certain things.

Like Plan G, Plan N doesn’t cover the Part B deductible. But where it differs from Plan G is that Plan N also requires you to pay up to a $20 copay to see a medical provider and a $50 copay if you’re admitted to the emergency room.

One last thing Plan N doesn’t cover is something called “excess charges,” which is a another term for balance billing. Excess charges allow doctors who don’t accept assignment from Medicare to charge an additional 15% for any care they provide. Here’s the thing about excess charges: they’re extremely rare. Less than 5% of doctors nationwide don’t accept assignment, which means they don’t accept the whole amount Medicare pays for any given service or procedure.

There are two very important reasons why only 5% of doctors don’t accept Medicare:

- They get paid LESS by Medicare

- They get paid SLOWER by Medicare

Plus, doctors who balance bill must collect directly from seniors, which means hiring additional billing support staff. When you consider that neither social security nor pensions are garnishable, it doesn’t make it worth it to go after senior clients for medical debt — which is why most doctors accept assignment in full.

To find out if your providers accept assignment, you can either ask them directly or look them up on Medicare.gov’s Assignment Page.

However, some states have adopted a Medicare Overbill Measure (“MOM”) that disallows balance billing to Medicare beneficiaries altogether. So, if you live in Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island, or Vermont, then you don’t have to worry about excess charges at all. This makes Plan N the go-to Supplement for seniors who want to save money but still have the freedom of a owning a Supplement policy.

Plan N Premiums

Plan N Supplement premiums usually cost between $400-$600 less per year than a Plan F. So, if you subtract the Part B deductible ($233 for 2022), usually you’re left with $150-$300 or more in additional savings. And since seniors on Plan N are only responsible for the $50 ER copay and up to $20 in doctor copays, you’d have to go to the doctor more than 10 in a year to exhaust those additional savings you’d get by choosing Plan N over Plan F. If you’re healthy, chances are you won’t even come close to wiping out those savings.

Below are the rates for both women and men who do and don’t smoke, according to age for a random zip code.

[TABLE]

These rates don’t include all the different companies’ rates, just the most competitive ones for each of the variables above. Also, these rates will differ in different zip codes. Some zip codes may be more expensive, which is why it’s imperative to find a broker who can compare all of your options at no charge.

Plan N Rate Increases

Seniors on Plan N can expect lower rate increases than Plan F, and sometimes even lower average rate increases than Plan G. This is because you’re taking more responsibility for the cost of your care by covering the copays and excess charges. You can expect rate increases to be around 2-6% or more per year.

This makes Plan N a very competitive Supplement plan to own — especially for healthy seniors who hardly ever go to the doctor. If you live in a MOM state then this makes Plan N the best one to own because you’ll be paying less per month with the lowest rate increases over time compared to Plan G or F.

Which Plan is the Best One for You?

Depending on what you want out of your Supplement plan, your preference will determine which plan is best suited for you. Plan F is the most expensive, but the most convenient (if you’re eligible) because you don’t have to worry about any out-of-pocket costs. Plan G is not as expensive but does require you to cover the Part B deductible yourself, so you trade convenience for additional savings. Likewise, Plan N has the greatest savings, but even less convenience because you have to cover doctor and ER copays, which has the potential to be an uncapped annual expense.

Usually, Plan G is the preferred middle-of-the-road choice, with moderate rate increases and moderate savings. If you’re healthy and don’t like wasting money on a plan you’re hardly using, go with Plan N. If you’re wealthy and don’t care how much you spend, then Plan F is an excellent choice — if you’re eligible.

Conclusion

We covered the three most popular Supplement plans and which is the best Supplement based on your individual circumstances. If you’re curious to see what the rates are in your area, feel free to hit the Quote button above, or peruse some of our other articles from our blog below.